Canada Income Tax Calculator

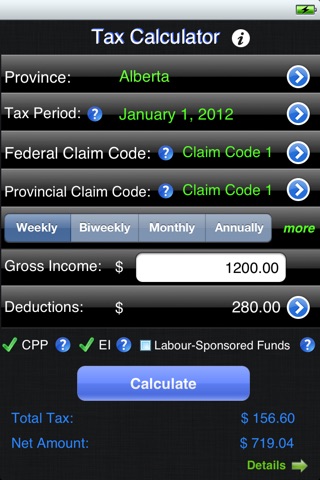

2012 tax rates except Quebec updated. This is the most up-to-date and powerful Canada income tax calculator in the App Store. Just Simply enter a few details about yourself, press "Calculate" to view concise, clear and detailed income tax report. With its super fast calculation and ability to easily switch between different pay periods, it is just under your finger tips to view and compare the tax reports based on your weekly, biweekly, semimonthly, monthly income, etc (all pay periods are supported). It works out:

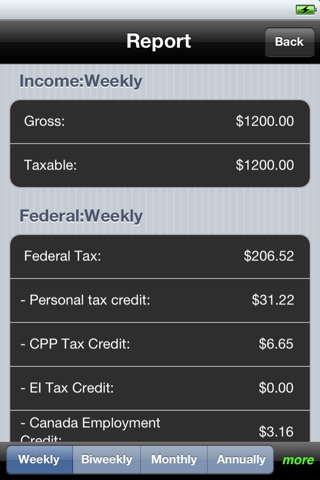

Income:

- Taxable Income

Federal:

- Federal Tax

- Personal non-refundable Tax Credit

- Canada Pension Plan Tax Credit

- Employment Insurance Tax Credit

- Canada Employment Credit

- Labor-sponsored Funds Tax Credit

- Total Federal Tax Deduction

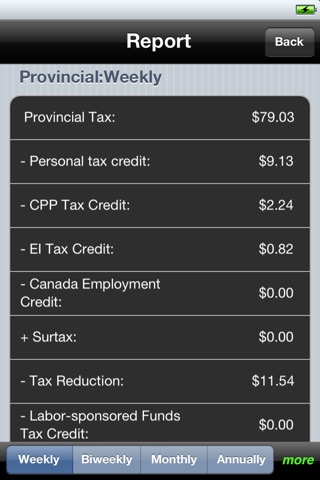

Province:

- Provincial Tax

- Personal Non-refundable Tax Credit

- Canada Pension Plan Tax Credit

- Employment Insurance Tax Credit

- Canada Employment Credit

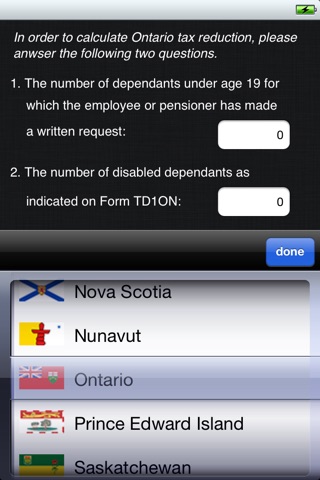

- Surtaxes in relevant provinces

- Provincial Tax Reduction in relevant provinces

- Labor-sponsored Funds Tax Credit in relevant provinces

- Total Provincial Tax Deduction

Summary:

- Total Tax Deductions

- Net Amount

Features:

- Work out income tax for all provinces except Quebec.

- Speedy calculation.

- Super fast switch and compare results based on different pay periods.

- Support for all pay periods: Weekly (52 pay periods), Biweekly (26 pay periods), Semimonthly (24 pay periods), Monthly (12 pay periods), Daily (240 pay periods), 10 pay periods a year, 13 pay periods a year, 22 pay periods a year, weekly (53 pay periods) and Biweekly (27 pay periods).

- Include Federal and Provincial claim code table for users to select.

- In the report, the elegant symbols in rows show how the tax is calculated. "-" means minus, "+" plus, "=" equals. (see screenshots for details)

The tax payable figure produced by the program is for your information only. We made every effort to make sure the correct results, however please note that calculations should not be considered as professional tax advice specific to your circumstances.

Version history:

1.3: 2010 tax rates except Quebec have been added.

1.2.1: fixed the version problem which could sometimes make the software be the LITE version and ask user to buy a full version.

1.2: fixed incorrect annual results.

1.1: 2010 is available. Net amount takes all deductions into account.